When you partner with a payment processor, you’ll receive a monthly statement that breaks down all the credit card processing fees that you’re paying to use their services in your restaurant.From processing fees to flat fees to situational fees, every last penny is laid out in these statements.

With 63% of restaurants accepting credit card payments, and cash payments plummeting in popularity, it’s more important now than ever to understand credit card processing fees and other key figures in your statements. After all, knowledge is power that can help you make informed decisions about your restaurant and payment processor.

In this article, we’re explaining what you’re paying (and why) by covering:

- The fundamentals of small business credit card processing fees

- How to read a credit card processing statement

- 4 things to look for when analyzing your monthly statement

Disclaimer: All of the information contained in this article is for informational purposes only and does not constitute legal, accounting, tax, or other professional or compliance advice. It is your responsibility to determine whether credit card surcharging is permissible in your jurisdiction. You are solely responsible for ensuring that your activity is compliant with the card network requirements and all laws applicable to you. Non-compliance may result in regulatory consequences or fines.

Everything you need to know about credit card processing

Credit Card Processing Fees Explained

Before you dive headlong into your statement, it’s important to double-check that you understand the fundamentals of small business credit card processing fees.

Everything you need to know is in The Ultimate Guide to Payment Processing for Restaurants, but here’s a quick refresher.

Payment processing companies charge three types of fees: flat, situational, and processing.

- Flat fees include online reporting, network, payment gateway, annual, and statement fees. Some of these debit and credit card rates and fees are negotiable and some aren’t – it pays to know the difference.

- Situational fees are charged as they come up for things like cancellations, chargebacks (customer refunds), international cards, and monthly minimums. You can negotiate rates for some of these fees as well.

- Debit and credit card processing fees will be the lion’s share of costs found on your monthly statement. Every time a customer uses their card to pay, that transaction comes with percentage-based fees that go to the issuing bank, the brand card network (e.g. Visa or Mastercard), and the payment processor, which routes the money from one entity to the other.

Your payment processor will filter and summarize these rates and fees, and you’ll see them as part of the credit card processing fees on your monthly statement.

Still in the market for an integrated payments processor? Here’s a pro tip: Be sure to choose a reputable organization with free 24/7/365 support, so you have the customer service you need to get the most from your monthly statements.

How to Read a Credit Card Processing Statement

Now that you have a basic grasp on what kind of fees you’ll find on your payment processing statement, now it’s time to learn how to read a credit card processing statement and what to look for.

The best way to read your monthly credit card processing statement is to zero in on these elements outlined below:

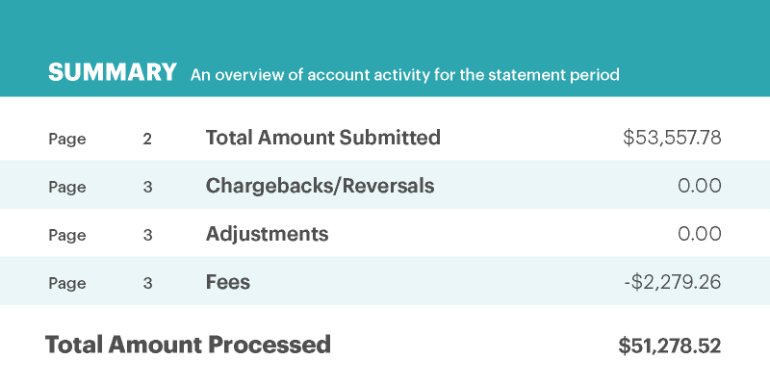

1. Find Your Effective Rate

The format of monthly statements will vary by company and pricing model, but most lead with the big numbers, i.e. your effective rate. This is the total dollar amount of your monthly credit card transactions minus the total dollar amount of fees. In other words, the effective rate is what you paid for restaurant merchant services.

A simple way to make sense of those numbers and understand how much credit card processing truly costs is to divide the total amount in fees by the total amount in transactions, and multiply by 100. This will give you the percentage of fees you’re paying per transaction.

For example:

($2,279.26 / $53,557.78) x 100 = 4.26% in credit card fees this month.

Do this quick calculation every month to see if your credit card fees are increasing, decreasing, or staying about the same. If you see a variation, you may choose to dig deeper into your credit card processing statement to understand where those extra fees are coming from.

It’s easy to miss a letter or email from your payment processor sharing news about increased rates, changing fees, or new charges they plan to levy. Finding your effective rate each month will help you know when to play detective on your monthly statement. If your effective rate varies every statement or shoots up or down one month, you’ll want to find the root cause and get in touch with your payment processor to make sure there haven’t been any big changes you should know about.

2. Identify Your Payment Processing Pricing Model

Even if your effective rate is relatively similar each month, it’s helpful to know which pricing model your payment processor uses to make sure it’s still the best fit for your business. Sometimes, processors can give you tailored rates or even blended pricing models that best suit your venue.

Here’s what you need to know about the three most popular payment processing pricing models:

Cost Plus Pricing

With a Cost Plus pricing model (aka Interchange Plus or Interchange Pass-Through), the merchant pays an interchange fee and processor markup.

The interchange fee is a non-negotiable fee set by the card network (i.e., Visa, Mastercard, etc.).

The markup is set by the payment processor and consists of a fixed percentage of the total check, the card brand fee, and a per-transaction flat fee.

A benefit of Cost Plus pricing is that these fees are transparent, so you can see a breakdown of all processing fees in your statement:

Interchange fee + % of total check + card brand fee + transaction fee = total processing fee

Example:

1.54% + 0.10% + 0.10% + $0.25 = 1.74% + $0.25 total processing fees

While the Cost Plus pricing model can be unpredictable due to fluctuating fees, it provides transparency into these fees after they’ve been charged.

Everything you need to know about credit card processing

Fixed Rate Pricing

Like the name implies, a Fixed Rate or Flat Fee pricing model charges a consistent fee month after month. Fixed Rate pricing usually consists of a percentage-based fee plus a dollar amount for each transaction.

% of total check + transaction fee = total processing fee

Example:

2.75% + $0.25 = 2.75% + $0.25 total processing fees

With a Fixed Rate pricing model, you know exactly what kinds of fees you’ll be charged when your monthly statement arrives.

Tiered Pricing

A Tiered pricing model sorts credit card transactions into three categories – qualified, mid-qualified, and non-qualified – based on the level of risk each card brand carries. Your payment processor charges the lowest fee for qualified transactions and the highest fee for non-qualified transactions.

| Qualified Transactions | Lowest Fee |

| Mid-Qualified Transactions | Mid-Range Fee |

| Non-Qualified Transactions | Highest Fee |

Example:

- Qualified transactions: 1.5% fee

- Mid-qualified transactions: 2.5% fee

- Non-qualified transactions: 4% fee

1.5% (qualified) + 2.5% (mid-qualified) + 4% (non-qualified) = total processing fees

Unfortunately, monthly statements don’t identify which credit card brands are qualified, mid-qualified, and non-qualified, making it difficult for merchants that use a tiered system to predict overall payment processing fees.

3. Understand Your Discount Model

Another critical part of your monthly statement to review and understand is the discount model, which refers to the billing cycle payment processors use. Most processors let you decide if you want to be billed on a monthly or daily discount billing cycle:

- A daily discount model charges processing fees at the end of each day. This discount model is usually more complicated to keep track of than a monthly model.

- A monthly discount model charges processing fees in one lump sum at the end of each month. This billing cycle can be simpler to track than a daily billing cycle.

Your discount method is important because it affects how processing fees are calculated.

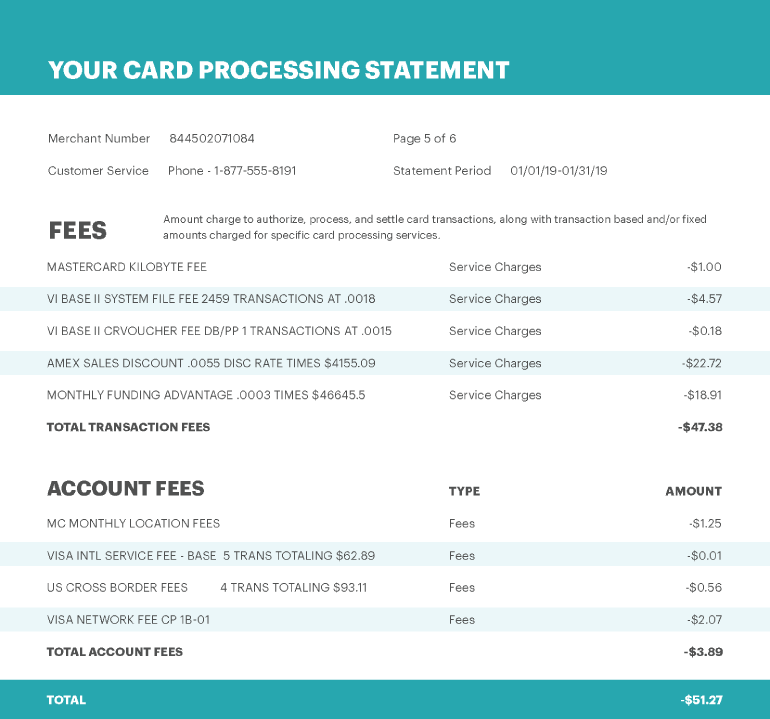

4. Review Negotiable and Non-Negotiable Fees

The final elements to pay attention to on your monthly credit card processing statement are your negotiable and non-negotiable fees.

Negotiable Fees

You’ll find two types of negotiable fees on your monthly statement: flat fees and situational fees.

Flat fees include online reporting, network, payment gateway, annual, and statement fees.

Situational fees are charged as they come up for things like cancellations, chargebacks, international cards, and monthly minimums. Take a magnifying glass to the flat and situational fee sections of your monthly statement. Make sure you understand each fee – and don’t be afraid to call your payment processor to discuss the negotiable ones.

Your rate negotiations with your payment processor can include asking questions about these fees. Not only will you learn important terms that will help you read future statements, but you’ll likely open a line of communication that could come in handy if you need to dispute any false charges that don’t reflect your account activity. These charges can be removed at the request of a merchant – if you’re paying attention.

While you’re pouring over your monthly statement, look for notices of rate increases. Keep an eye out so you know exactly what to expect, and be sure to ask if you’re not sure if the new rates are negotiable.

Non-Negotiable Fees

Another fee to pay attention to is your interchange rate. As you know, interchange rates are set by individual credit card companies (like Visa or Mastercard), not payment processors, and are not negotiable. These rates are typically adjusted twice per year and are publicly posted on credit card brand websites. As a merchant, you are entitled to 90 days’ notice by your payment processor when the interchange rate – or any fee – changes. When you receive a notice of a rate increase, you are allowed to cancel your contract within that 90-day period, without the threat of a penalty.

Knowledge is Power When It Comes to Credit Card Processing Fees

Taking the time to understand all of the credit card processing fees on your monthly statement is a worthwhile investment into your business. Make a habit of reviewing each statement to track patterns and spot red flags. If your effective rate or situational fees get out of hand, consider looking for a new payment processor.

Learn how to save money on payment processing fees

Sign up for our free weekly TouchBistro Newsletter