If given the choice, the majority of today’s diners would prefer to pay with a card over cash. In order to make that option available, you need the help of restaurant merchant services providers. A merchant services provider is a valuable payments partner that facilitates credit card processing in your restaurant, and performs other important services.

Keep reading to learn everything you need to know about restaurant merchant services, including:

- What merchant services for restaurants means

- How credit card processing works

- How restaurant merchant services providers set their rates

- Popular payment processing pricing models

- How to choose a provider

- The value of restaurant merchant services providers

What is a Restaurant Merchant Services Provider?

Before we dive in, let’s clarify a few very important terms: credit card processors and merchant services providers.

Credit Card Processors

Credit card processors specifically refers to the companies working behind the scenes to maintain the technical communication between merchant services providers and the banks. These processors play an important role in processing your credit card transactions, however they have no direct relationship with your business. In fact, your payment processor is chosen by the bank your merchant services provider partners with.

Restaurant Merchant Services Providers

On the other hand, merchant services providers have a very close relationship with your business.

Just as the name suggests, merchant services providers (also known as restaurant merchant accounts providers) supply merchants (the term used to refer to their customers, in this case restaurants) with every payment component needed to accept non-cash modes of payment both online and offline.

In other words, restaurant merchant services allow you to accept credit or debit card transactions through a payment card reader, your point-of-sale (POS) system, or online (also known as a card-not-present transaction).

It’s important to note here that merchant services providers aren’t the only type of payment service providers out there.

When you’re deciding how to accept credit card payments in your restaurant, choosing your provider will come down to a decision between a merchant services provider and a payment processing aggregator.

Payment Processing Aggregators vs Merchant Services Providers

So, what is a payment processing aggregator?

Aggregators are payment service providers that register merchants (like your restaurant) directly under their own merchant ID number and process payment transactions through a single master account. Square is an example of an aggregator.

Payment processing aggregators are popular with small businesses because there’s no lengthy application process, so you can start accepting credit card payments quickly and easily. Aggregators are also popular among small businesses that process a low volume of transactions because aggregators provide a streamlined payments solution and charge a predictable flat fee per transaction.

Merchant services providers are more popular with larger or higher volume venues looking for an integrated payments solution. What makes merchant services providers different is that they assign each business a dedicated merchant ID.

Merchant services providers also supply a range of additional services, like a personal account representative, software for transaction tracking, and guided POS integration.

Restaurant merchant services providers usually provide a pricing model where you pay exactly what the card costs (i.e. cost plus or interchange plus pricing).

Everything you need to know about credit card processing

How Does Credit Card Processing Work?

In addition to providing you with essential hardware such as credit card readers, payment processors and many of the best merchant services for restaurants also do quite a few things behind the scenes.

Before we can explain how the credit card processing works, we need to break down each of the additional players involved:

- The customer (the diner making the payment);

- The merchant (your restaurant);

- The credit card network (e.g. Visa or Mastercard); and

- The issuing bank (the institution from which the diner received his or her credit card, such as Chase or TD Canada Trust)

Both payment processors and restaurant merchant services providers work with all these players to fulfill their most important task for you: to clear and route the transaction so that the diner’s money is deposited safely into your restaurant merchant accounts.

This is accomplished through the following steps:

- The customer requests to pay by credit card.

- You authorize their credit card by inserting it into a payment terminal. Your merchant services provider receives that information and passes it on to the credit card processor and the credit card brand network (i.e. VISA, Mastercard, American Express or Discover).

- After the banks have confirmed that the credit or funds are available, your credit card processor relays this information back to your restaurant merchant services provider.

- The credit card card brand network requests payment authorization from the customer’s issuing bank.

In short, your processor communicates transaction information between the merchant services provider and the network, while your merchant services provider takes care of the initial input and output of transaction information from the cardholder.

When you close out at the end of a business day, you’re sending a batch of all your approved authorizations to your payment processor. After that, the process looks like this:

- The payment processor sends the information to the appropriate card network and, at the same time, deposits the appropriate funds into your account (and debits all associated processing fees).

- The credit card network, meanwhile, debits the merchant’s bank (i.e., the issuing bank) and reimburses your payment processor.

- You, the merchant, are then required to repay your issuing bank when you receive your credit card statement at the end of the month.

Ultimately, merchant service providers are responsible for making sure everyone gets a slice of the pie and they also assume the majority of the risk if something goes wrong (i.e., if a customer uses a fraudulent card or your restaurant ends up going bankrupt).

In exchange for their services, merchant services providers will charge you a fee. Exactly how much depends on a number of different factors.

One factor is the type of payment. Generally, the more secure the form of payment, the less expensive it is. For example, swiping a card through a credit card reader (a magstripe payment) costs more per transaction than a restaurant mobile payment because the former is more open to fraud.

What is credit card fraud in this context?

Credit card fraud is when someone steals a customer’s card information, a personal identification number (PIN), or the actual physical card and uses it to pay for something. Magstripe cards are particularly vulnerable to this, which is why EMV technology was developed to replace it.

And what is EMV?

EMV simply refers to the computer chips and technology used to authenticate card transactions. Learning about the EMV liability shift, credit fraud, and growing risks is a good first step toward preventing fraud in your restaurant.

How Restaurant Merchant Services Providers Set Rates

The credit card processing fees you pay will likely differ from the fee paid by the restaurant down the street. That’s because these rates depend on a variety of factors, and they vary from one merchant services provider to the next.

These factors include:

- Your industry

- Your business and credit history

- Your projected or established transaction volume

- The number of card swipes expected to take place in a given month or year

- Your average transaction sale

These factors help the merchant services provider determine what type of risk you carry and how much business it can expect to see from you.

Everything you need to know about credit card processing

Payment Processing Pricing Models

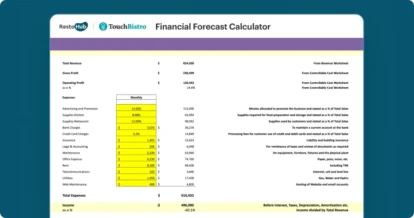

As you learn about the best merchant services for restaurants, you’ll see three types of credit card fees outlined in your payment processing contract: flat, situational, and processing.

Flat Fees

Flat fees are the fees you’ll see every month with little variance – meaning, they’re not percentage-based. These will include terms like network access fee, monthly fee, and online reporting fee.

Situational Fees

Situational fees are charged on a per-event basis, so you won’t see them all the time. They can include charges like monthly minimum fees, international fees, and set-up fees.

Processing Fees

Along with the processor markup fee we mentioned before, you can expect to see a couple other processing fees on each transaction, such as:

- Interchange fee: A percentage-based cost of authorizing a transaction, charged by the credit card companies.

- Card brand fee: A percentage-based fee paid to the credit card network on each transaction.

While some of these fees are non-negotiable, others come with a bit of wiggle room.

Questions to Ask Your Restaurant Merchant Services Provider

Before you partner with a restaurant merchant services provider, perform due diligence to ensure you’re an educated consumer.

We’ve put together a list of questions to ask merchant services providers, as well as why these questions are important ones to ask.

1) What Can I Expect to See On My Bill?

Ask your restaurant merchant services provider which pricing structure they use. In other words, how do they charge for their services and what fees you can expect to see on your monthly bill?

Transparency is the top sign of a good provider!

2) What Benefits Do You Provide Merchants?

Ask your restaurant merchant services provider what benefits you’ll be able to gain by working with them.

Perhaps they offer best-in-class customer support, or an innovative software solution that also helps with inventory management. Maybe they excel in mobile credit card processing and offer quick payouts and accurate billing.

Whatever it is, ask them to lay it out for you in detail and make them explain why it matters to your business.

3) How Can You Support My Restaurant’s Unique Needs?

Consider what makes your restaurant unique from other businesses, and ask your merchant services provider how they can meet your needs.

For example, maybe you run a food truck that constantly loses its internet connection. Does your provider offer an offline mode that lets you process non-cash payments no matter what?

Or, you oversee the food and beverage services of a sprawling resort. Does your merchant services provider offer mobile payment processing hardware that servers can take from pool cabanas to beach-front chairs?

4) Are You PCI Compliant?

Chances are if your chosen provider is able to work with the major credit card brands, their terminals are PCI compliant. But it doesn’t hurt to ask.

If they’re not, you need to know, otherwise you could be charged a huge fine by the credit card companies.

If they are, they may have additional security features they’d like to tell you about – such as full-service integration options that could strengthen your POS system. Even if you’re not in the market for them, it’s good to know they exist, just in case you need them down the road.

Find out which fees are negotiable and how to get the best price.

The Value of Restaurant Merchant Services Providers

Restaurant merchant services providers are valued partners that make it possible for your restaurant to accept all kinds of non-cash payment methods. They offer payment security, account help, and POS integration to keep your business running smoothly.

Want to learn more about payment processing?

GET THE ULTIMATE GUIDE TO PAYMENT PROCESSING FOR RESTAURANTS

Learn how to save money on payment processing fees

Sign up for our free weekly TouchBistro Newsletter